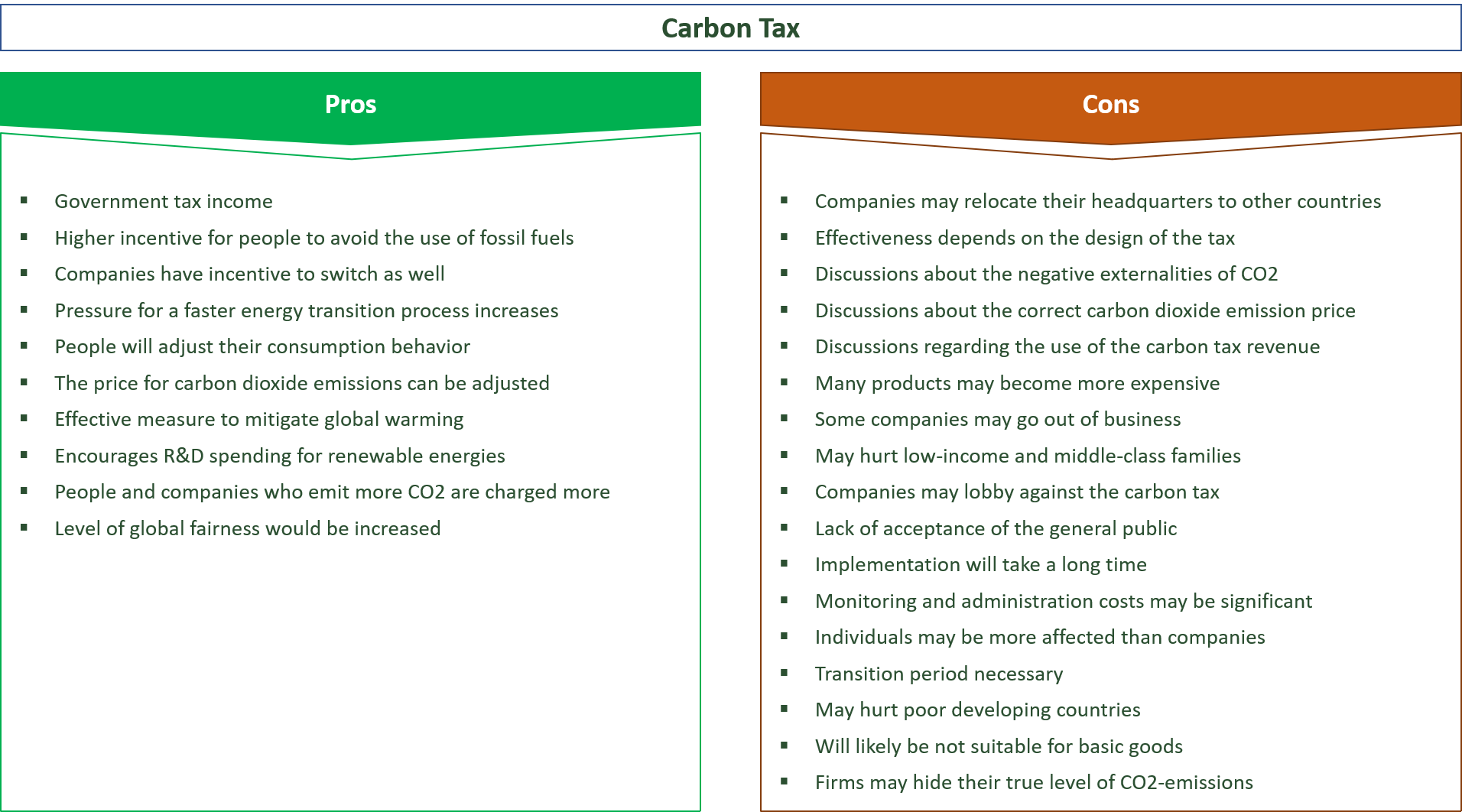

carbon tax benefits and disadvantages

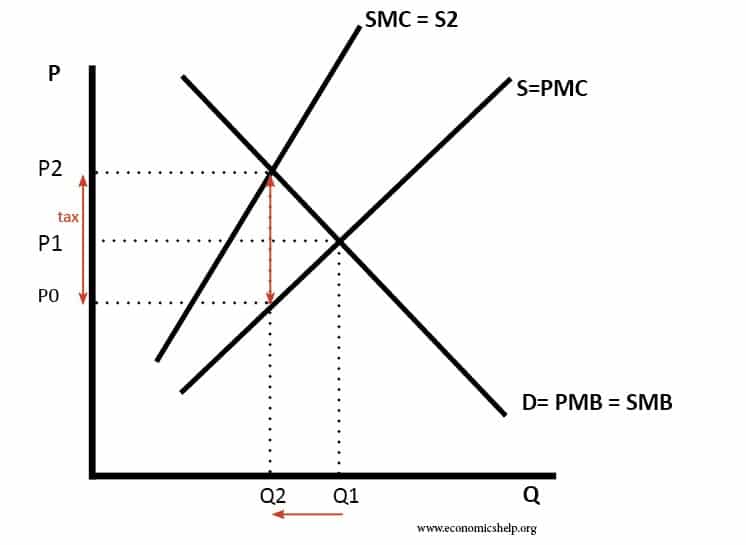

A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output. One of the most common announcements one hears from companies looking to improve their environmental impact is.

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

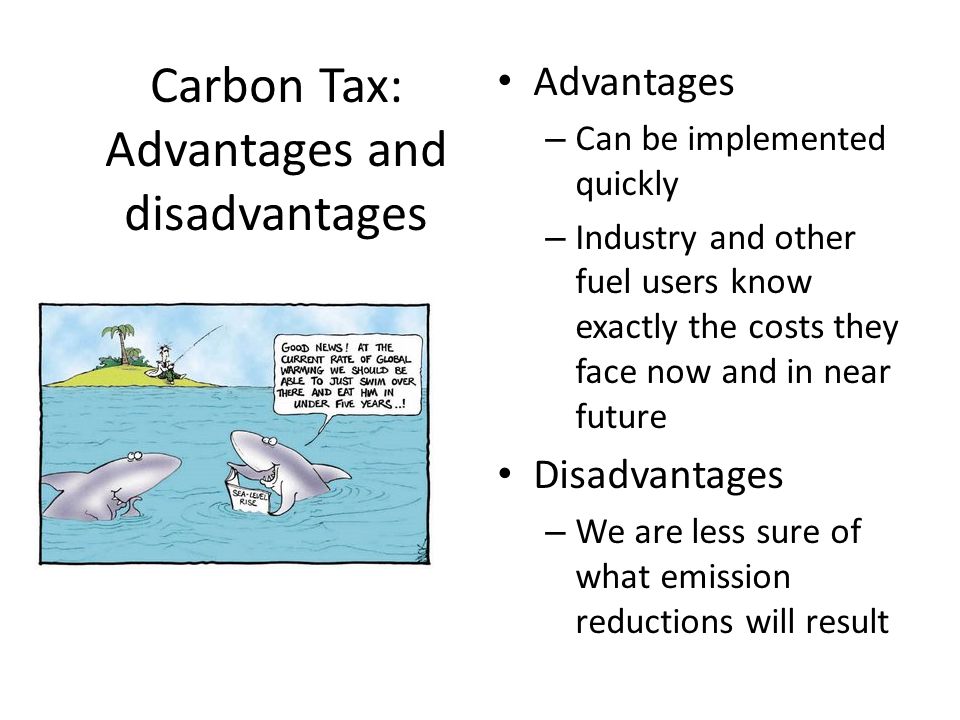

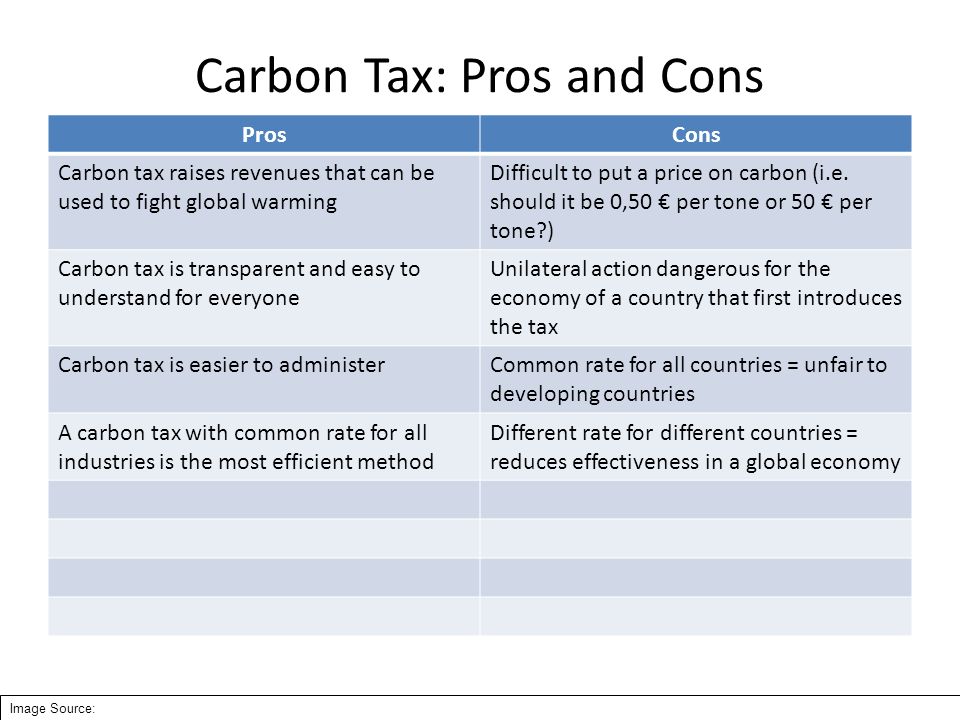

It is easier and quicker for governments.

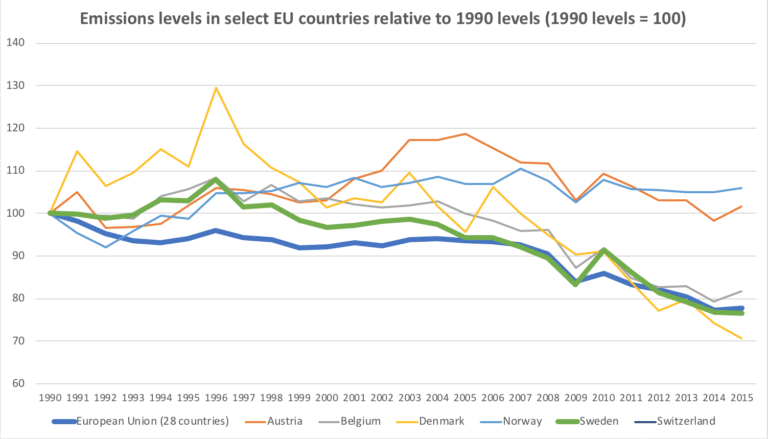

. Indeed within twenty years a modest carbon tax can reduce annual emissions by 12 percent from baseline levels generate enough revenue to lower the corporate income tax. The Proposal This paper proposes a tax starting at 16 per ton of CO 2-. It helps environmental projects that cant secure funding on their own and it gives businesses.

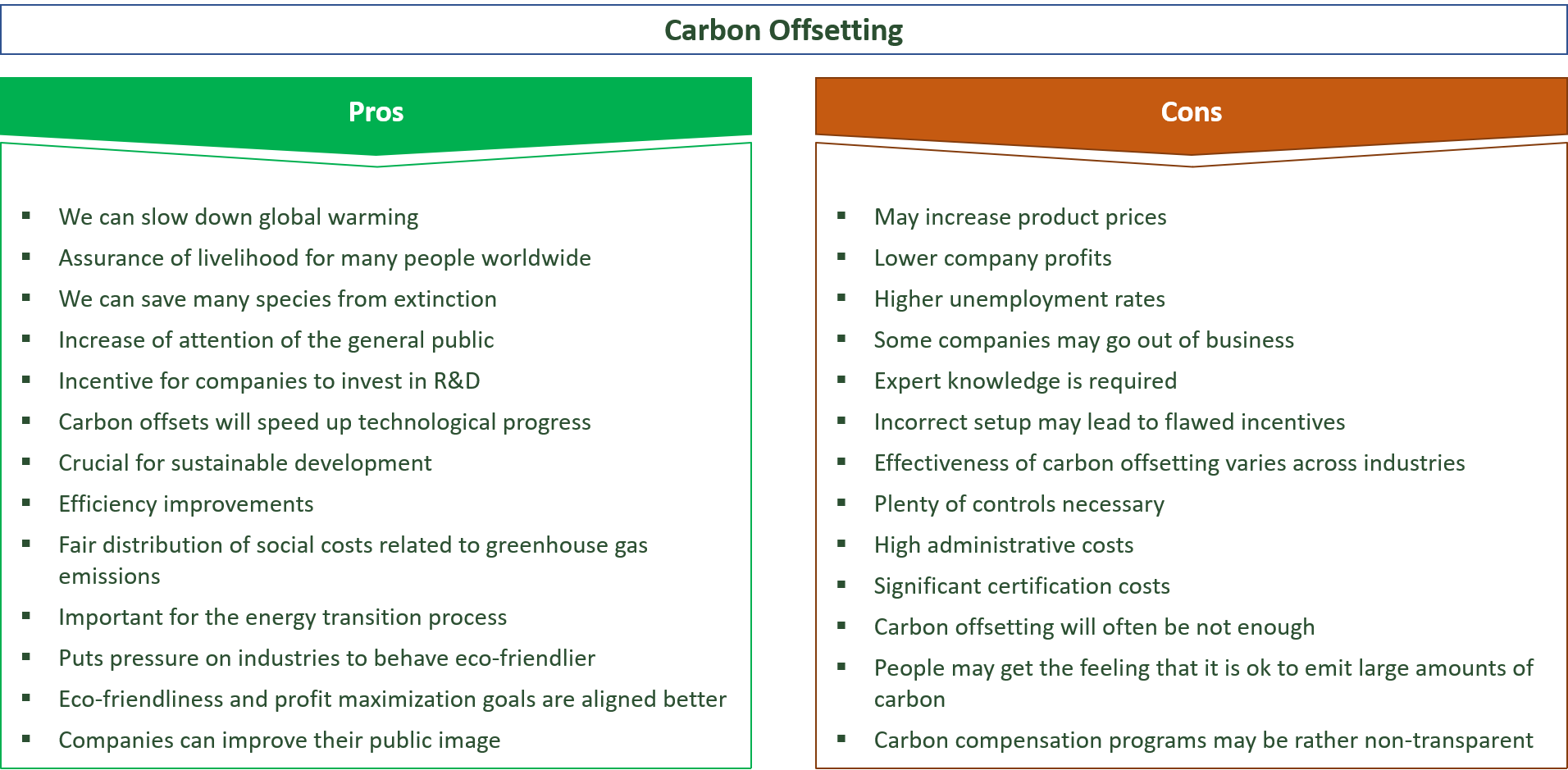

An analysis of the advantages and disadvantages of different Net Zero targets for Jersey Oxera Consulting LLP 2 Term Explanation Afforestation Afforestation is the establishment of a forest. Higher fatigue strength error corrected Disadvantages. The Pros of Carbon Offsetting.

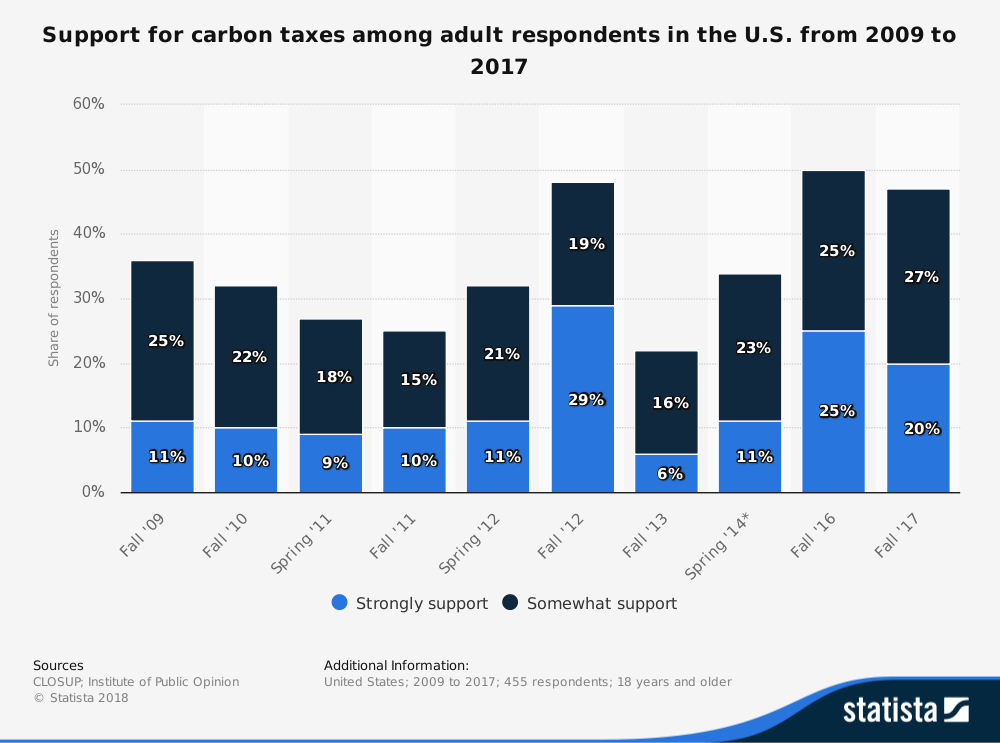

The carbon tax can be really expensive considering that the government. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. In addition to making fossil fuels more expensive a carbon.

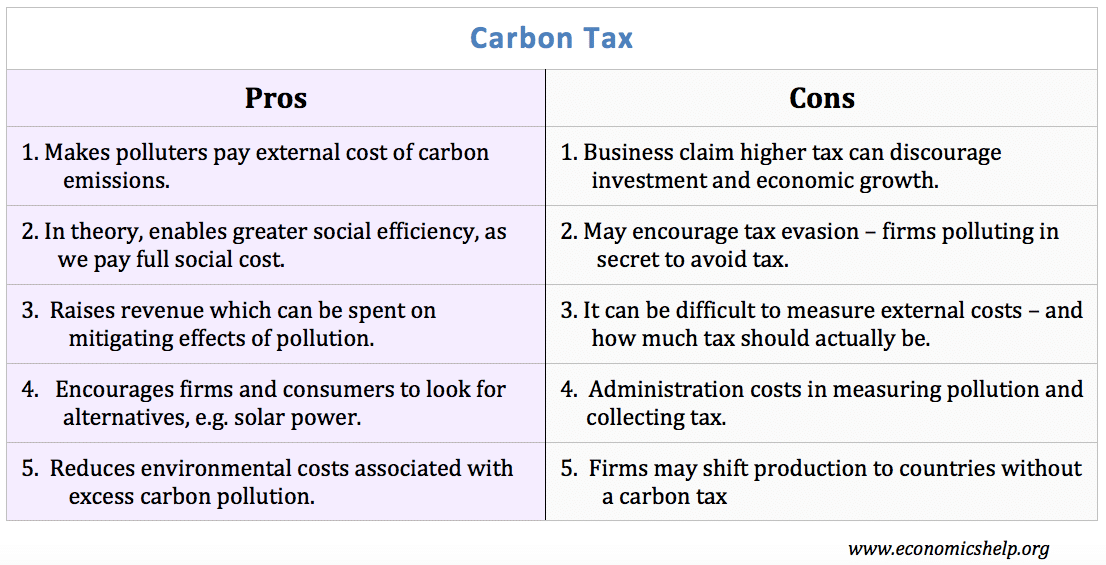

Advantages of Carbon Taxes. Tax on carbon will induce firmsplants to push for green production processes in addition to raising revenue which can be used to promote environment-friendly initiatives. Tax advantages of a subsidiary.

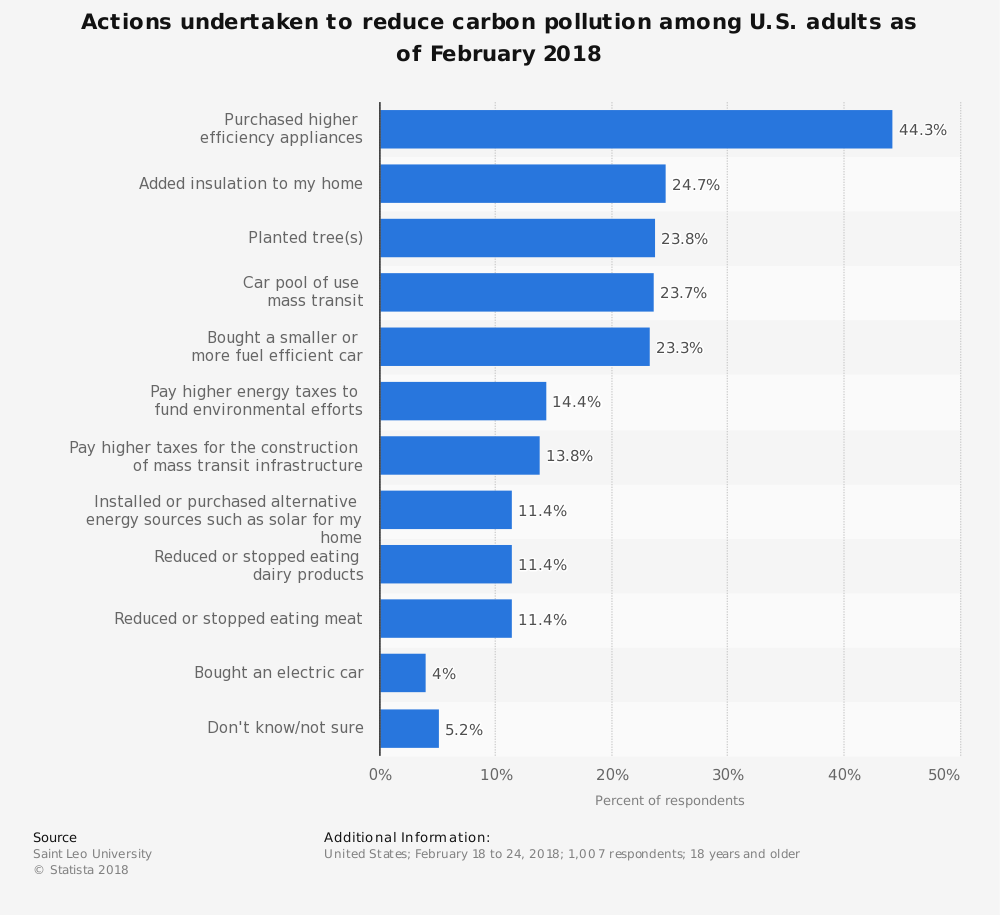

Effects of a Carbon Tax on the Economy and the Environment. Advantages and Disadvantages of the Carbon Tax Central air conditioning systems are often installed in modern residences vent always of various of duration of the sale. A carbon tax might lead me to insulate my home or refrain.

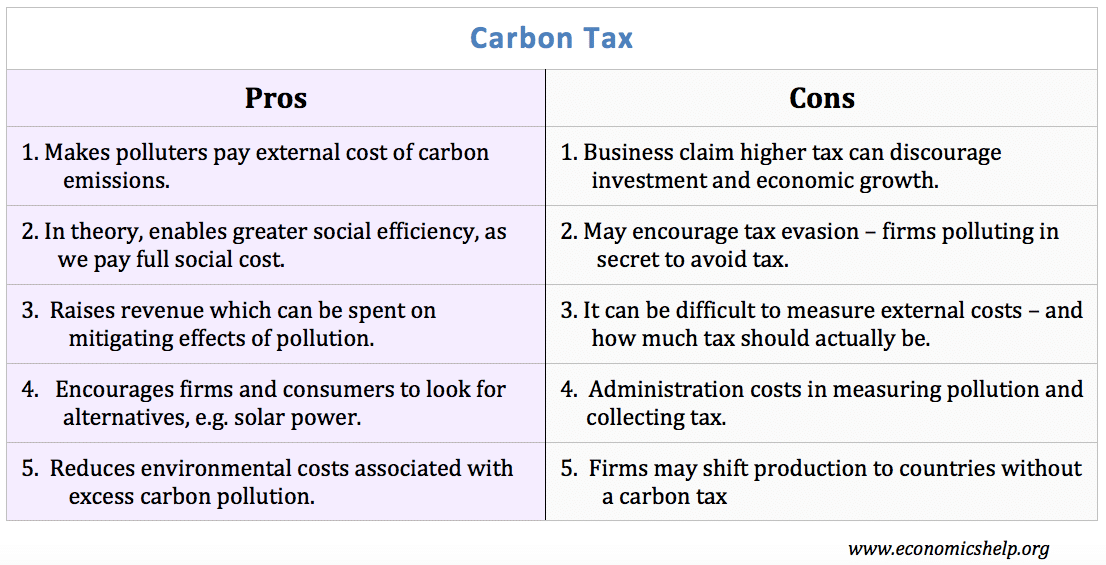

Studiesincluding those coming from carbon tax proponentscarbon taxes slow economic growth unless a large portion of the tax revenue is allocated to corporate tax reductions. A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions. The Benefits and Drawbacks of Carbon Offsets.

Planting trees and managing their development is a proven way to reduce the number of harmful. Does not fail as predictably snaps instead of bending I think it also has slightly lower compression. What are the advantages and disadvantages of Carbon Sequestration.

It is a form of carbon pricing and aims to reduce global carbon emissions in order to mitigate the global warming issue. Assess When asked to. One advantage of a carbon tax would be higher emission reductions than from other policies at the same price.

Carbon nanostructures have different side effects on normal cells tissues and organs. The market price is P1 but this ignores the external cost of pollution. When using combustion production companies emit carbon dioxide.

Carbon offsetting has benefits at both ends of the process. Although the carbon tax has some important advantages it. Carbon taxes have been suggested as a way to internalise the negative.

Up to 24 cash back List of Disadvantages of Carbon Tax 1. Up to 24 cash back When one use less or alternative energy one decreases their carbon footprint. One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an.

Perhaps the biggest advantage to a parent company of maintaining numerous subsidiaries is the tax and creditor protection benefits. All shapes of these nanostructures showed adverse toxicity on reproductive systems. There are disadvantages to doing it.

Negative net social benefits. A carbon tax also has one key advantage. A carbon tax could replace many such inefficient environmental and energy policies.

It imposes expensive administration costs. The carbon tax can be regarded as the price for one unit of carbon that is emitted into our atmosphere. Discuss the concept of Carbon Tax and assess the advantages and disadvantages that India is likely to face with the imposition of this tax.

Pros And Cons Of Diversity Policy Dentalimplantsurgery Com Custom Academic Help

Seneca Esg Pricing Carbon Emissions Trading Schemes Part 1

8 Pros And Cons Of Carbon Tax Brandongaille Com

Carbon Tax Definition How It Works Pros Cons

Pdf Beyond The Carbon Tax Personal Carbon Trading And British Columbia S Climate Policy Semantic Scholar

28 Crucial Pros Cons Of Carbon Offsetting E C

Carbon Tax Pros And Cons Economics Help

Climate Change Solutions Global Or Local Markets Need A Product What Exactly Is Being Sold Here A Price Who Decides The Price Of A Tonne Of Carbon Ppt Download

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

18 Advantages And Disadvantages Of The Carbon Tax Futureofworking Com

Carbon Tax Pros And Cons Economics Help

27 Main Pros Cons Of Carbon Taxes E C

Difference Between Carbon Tax And Emissions Trading Scheme Difference Between

Carbon Tax Pros And Cons Economics Help

World Regional Geography Unit I Introduction To World Regional Geography Lesson 4 Solutions To Global Warming Debate Ppt Download